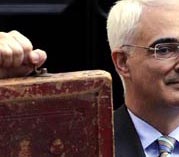

The one aspect of the 2009 Budget that made the headlines was the 50% Income Tax that will be levelled on incomes over £150k. And let’s recall what that means: if you earn more than £150k, you’ll pay 50% on that portion of your wage over £150k. I’m personally in favour. The Tories haven’t said they’re against. Not many people relate to it, in my experience so far. I suspect it’s a genius move.

The one aspect of the 2009 Budget that made the headlines was the 50% Income Tax that will be levelled on incomes over £150k. And let’s recall what that means: if you earn more than £150k, you’ll pay 50% on that portion of your wage over £150k. I’m personally in favour. The Tories haven’t said they’re against. Not many people relate to it, in my experience so far. I suspect it’s a genius move.

Four overheards and conversations:

Overheard in the City of London:

Well-dressed lady: Paying 50% tax is a problem I’d like to have

Via Text (re the Chancellor):

Public sector worker: I’m not sure what else he could have done.

In the pub:

Me: Hey Jeff. What do you think about the Budget?

Jeff (SME, who votes Tory): Fags, beer or petrol?

On the phone:

High earner on more than £150k PA: I’m £15k worse off. Your government did that.

Me: I’m not going to apologise.

High earner: I work hard for my salary.

Me: Lots of people work hard. Plenty of people work harder than both of us.

High earner: It’s hitting me hard. What have you got to say about that?

Me: On behalf of a grateful nation, we thank you for your support. (Laughs)

Jeff and most of the country, I’d suggest.

I totally agree with you Dan, lots of people work very very hard for a considerably lesser sum than your Fat Cat Chappie.

Since it seems that the worry of the Conservatives is that higher bracket tax payers will silt it all away in stocks to pay the lower rate of CGT instead of PAYE, it would appear that, for many, the extra cash is not something that will be circulated into the economy.

I often wonder what is the point of accumulating cash just for the sake of it? But I have a strange feeling I may never find out 😀

The theory goes however that high income earners are attracted to places with low tax rates, and high income earners then create jobs and business.

It’s also said that Britain will not be able to attract top talent if tax rates are too high. This is to some degree true. (I have some friends who’s careers would be better advanced by returning to the UK from abroad, but the effective pay-cut and cost of living hit is unattractive)

The question is, out of the £150k+ crowd, how much is worth top talent and how much is overpaid turds. Hard to say.

I think it would have been interesting had the government matched this with incentives for investors, entrepreneurs and helping small businesses. I think their is a lacking of real creativity here. We should really be encouraging companies with say <20 employees or £2mil in revenue to run effective and sustainable business as well as help reduce some of the risk for investors and small business. I’m not sure we’re doing enough of that.

All that said, I’ve no idea how good or bad the budget is in real terms. I don’t feel I have the necessary knowledge to evaluate this properly, and I don’t feel the news or press is helping at all.

Probably a good comment on this by @mikee: http://twitter.com/mikee/status/1603032337

50% income tax will stop higher earners coming to this country, and burden the earners we already have here with unnecessary, excessive taxation. The CEOs of businesses paying out large amounts in tax aren’t going to lift it from their own lifestyle, they’ll simply cut away jobs. Shit always runs downhill.